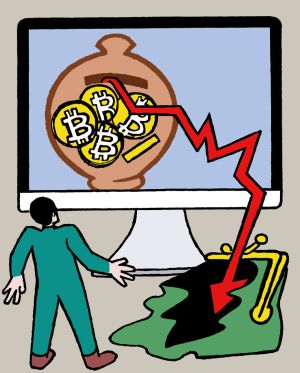

The European Banking Authority (EBA ) has warned all citizens to do the bitcoin pupa . Ojo who traded with him. The

Bitcoin is a virtual currency that was created five years ago by a

person or group of persons of which virtually nothing is known. It is a currency that is not behind or authority or control. During

these five years the currency has circulated around the Internet like

so many other virtual currencies , but in the last year the value of

bitcoin has increased from 10 to 500 euros and its use is not only trade

online , but also to shopping in physical stores , bars and even college tuition .

Moreover, ideas for start running to become

currency

of physical territories as the island of Alderney in the Channel or the

University of Cyprus encourages his country , who suffered a playpen

with euro in March , becoming a European laboratory on the use of this

currency .

If

only in the cyberworld , the popularization of bitcoin caused the alert

EBA , which means that the bitcoin can not take a joke. Not

so much for the apocalyptic tone of the document addressed to the

consumer, but the shadow begins to question traditional banking

practices.

Interestingly

a week ago that the Bank of America Merrill Lynch published a lengthy

document with a very different tone , where bitcoin highlighted the

risks ( volatility, both worth a day 600 as 800 euros ), but also its

advantages and benefits . In that letter , he said he did not believe in the possibility that the bitcoin become haven for money laundering . Like

the EBA , Bank of America recognizes that bitcoin can be stolen , lost

or forged, but easier is this happening for real currency.

The

bitcoin itself is new and strange, because neither seen nor touched,

but it is noteworthy that the banking authority nothing to warn the

consumer preference or playpens , pyramidal or practices of banks that

agree to speculate on the Euribor. The virtual currency, itself, is a risk , but as life itself .